california mileage tax bill

1 day agoCalifornia cuts cannabis taxes to aid. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that includes building out.

Paying By The Mile For California Roads Infrastructure Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

Businesses impacted by recent California fires may qualify for extensions tax relief and more.

. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. Californias Proposed Mileage Tax California has announced its intention to overhaul its gas tax system.

California Politicians Want a New Mileage Tax. The 305 billion transportation bill approved by Congress last year included a package of offsets from other areas of the federal budget that totaled. Replacing Californias gas tax.

California Expands Road Mileage Tax Pilot Program. Just like you pay your gas and electric bills based on how much of these utilities you use a road charge - also called a mileage-based user fee - is a fair and. California Mileage Tax.

Between 2008 and 2014 at least 19 states considered 55 measures related to mileage-based fees according to. Drivers would be able to opt out of tracking their mileage and pay a flat annual fee of 400 a provision that would expire in 2030. Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos Politifact Biden Infrastructure.

The law though does not reveal how the state will collect the necessary information to track mileage. But in order to get enough votes SANDAG officials were forced to. Now California politicians are proposing a costly and unfair new.

SAN DIEGO KUSI In December 2021 SANDAG passed its regional transportation plan. The new rate for. You Can Stop Them In 2022 June 29 2022 Forget the gas tax.

Since 2015 the program allows the state to. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. Please visit our State of Emergency Tax Relief page for additional information.

You can think of it as a pay-per-mile tax that subsidizes government programs. This means that they levy a tax on. California mileage tax bill Tuesday June 14 2022 Edit.

Im authoring a bill SB339 to evaluate a road charge based on. Traditionally states have been levying a gas tax. The bill would require.

For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile10They both increased. California recently authorized its own mileage tax pilot project. The bill would require the Transportation Agency to consult with appropriate state agencies to implement the pilot program and to design a process for collecting road charge.

October 1 2021 Keith Goble California Gov. What is a mileage tax. Mileage tax is a type of tax that is paid by the driver based on miles driven.

Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee.

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

How Do Food Delivery Couriers Pay Taxes Get It Back

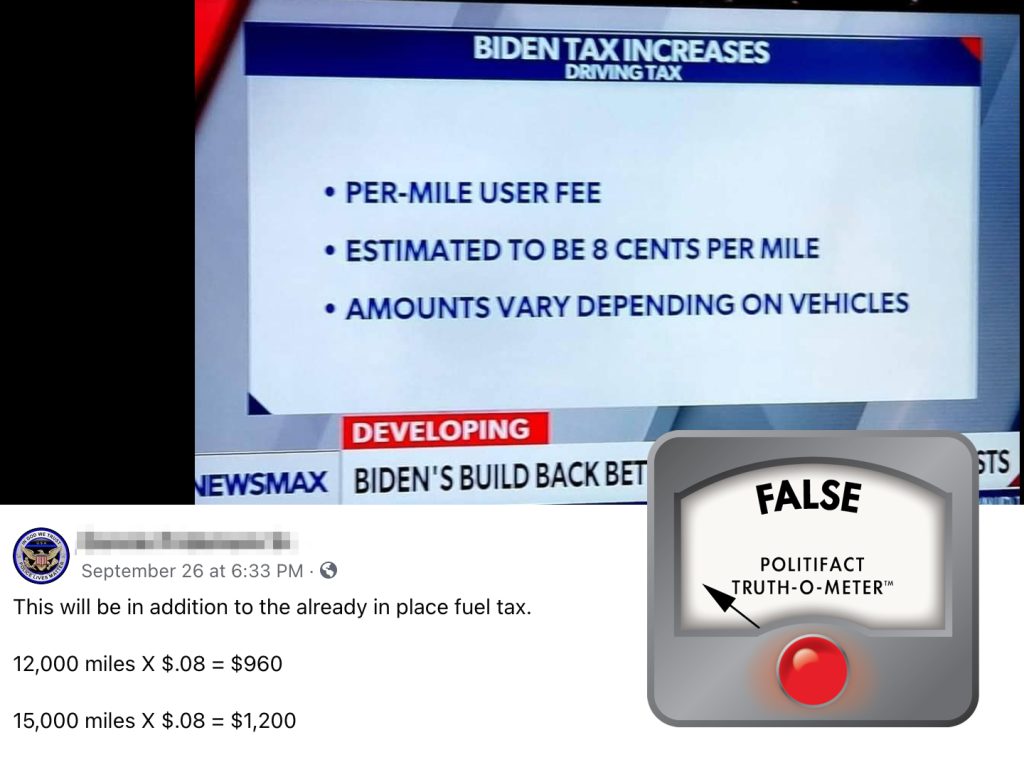

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

Examining Mileage Based User Fees As A Replacement For Gas Taxes Reason Foundation

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Local Mayors Get Cold Feet On Plans For Mileage Tax On San Diego Drivers By 2030 Kpbs Public Media

Secured Property Taxes Treasurer Tax Collector

What Are The Mileage Deduction Rules H R Block

County City Leaders Push Back Against Proposed Mileage Tax

Vehicle Miles Traveled Tax Proposed

Infrastructure Package Includes Vehicle Mileage Tax Program

Everything You Need To Know About Vehicle Mileage Tax Metromile

Irs Mileage Reimbursement 2022 Everything You Need To Know About

Biden Has Options Beyond A Corporate Tax Hike To Pay For Infrastructure

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

Sandag Adds Per Mile Tax To 160 Billion Transportation Plan Proposal Nbc 7 San Diego